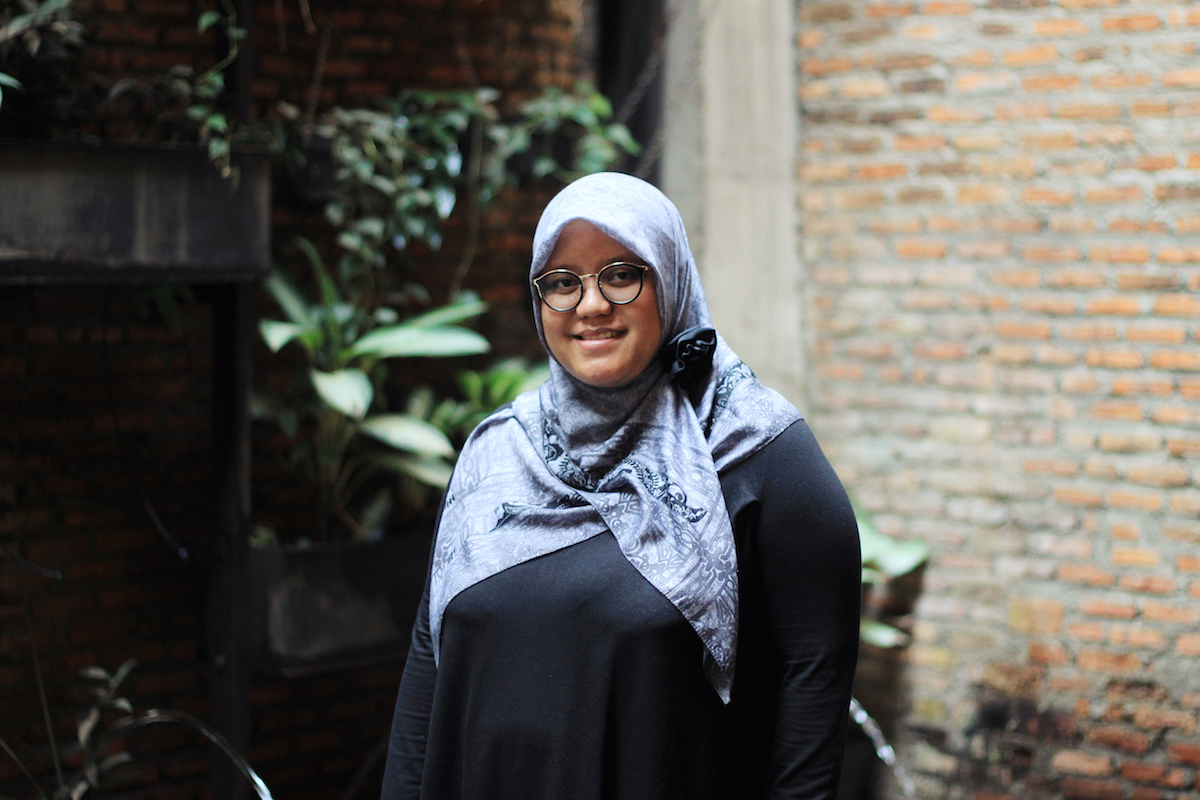

Tell us about yourself.

My name is Indah Maryani and I am the COO and co-founder of Infradigital Nusantara. We built this company in December 2017. I’ve been partners with my co-founder for seven years now and it has been an interesting journey.

I have been in the payment industry for the last 15 years. I was a part of the first wave of digital wallets, and have carried out the installation and implementation of digital wallets in many countries throughout Africa, Europe and America. Seven years back when I met my co-founder, we were both working in a startup called Fusion Payment. As you know, the digital wallet market is very competitive, with big players such as GO-PAY and Tokopedia. We saw that the competition was very stiff, and we realized that in payment systems what you want is recurring transactions. Basically what we did was create a platform called Beruang, which allowed you to buy all the digital goods like pulsa, electricity, and water – goods that you pay recurrently every month – as products on our platform. However, we realized that everyone was playing the same game. Everyone was developing their own versions of digital goods products.

Back then, my co-founder and I were trying to onboard traditional merchants to do online payments through our product. It was very difficult because we were such small players; when we offered Beruang as a platform, they were asking questions about us and who we were, but they were excited about the fact that our product enabled them to digitize their billing and pay through any method they wanted. After that experience, my friends and I decided to quit our jobs at the time to create Infradigital.

What exactly does Infradigital do?

Infradigital allows non tech-savvy businesses to digitize their bills. For instance, schools, apartments and SMEs. There are many schools in Indonesia, and a lot of them had not tapped into the possibilities of technology yet. They did everything manually. Let’s say if you wanted to collect payment from the parents, you would hand over a paper to the student, who then passes it on to their parents. Basically, it was a very manual job. We helped these institutions digitize their bills and connected them to all the payment methods available now in the digital ecosystem. So, it’s not only using a bank account. Not only using banks, but wallets and retail markets too (ie. Indomaret). It applies to any kinds of channels that the consumer wants. From there, since the bills are already digitized, the bills could also be leveraged for other things, like student loans for instance.

What challenges have you faced so far as a one-year-old startup?

In a startup, time and money are very important. Naturally, you have limited time and limited resources. You have to move fast and prove that your product has a lot of traction, which requires a certain amount of focus. We launched our product in March and the first traction was only around 150 million Rupiah of transactions per month but now we are able to process transactions as large as 2.2 billion Rupiah per month. We are actually seeing a lot of traction, but it’s just that it’s always a busy day. Because you always have to find the right product with the right market fit, you always have to listen to your customers, but you also have to do things like fundraising simultaneously. So, juggling all these things at the same time is challenging.

You’ve been running your startup for less than a year and you’ve already grown to over 2 billion Rupiah worth of transactions! How did you gain traction so fast?

It’s funny because we actually sell our product door-to-door. First we visited around 100 schools per month and administered surveys to over 2000 parents. These schools weren’t even in Jakarta – they were in Depok and other pre-rural areas. We asked them whether they were ready to migrate to digital payment. Out of the 2000 parents that we asked, 80% of them were ready to do so. The schools and other partners were keen as well. We saw that there was a lot of interest amongst the parties and we knew that in the near future, offline payments would be obsolete. But capturing the market was not as easy as we thought, because the people we were targeting were traditional people.

So, we came to them selling door-to-door. Back then, the system wasn’t even built yet; we were just marketing a prototype. But still, people showed interest in our product. In the first month, we got 20-40 schools signed up, but none of them had started using the product yet. In our sales funnel, there are two processes involved: acquisition and activation. Because we saw a lot of interest, we provided the platform for free as long as they were willing to migrate to our system. Migrating was taking a lot of time because literally everything was done manually, so in order to create a database of students, our team had to take pictures of them one by one and upload them in an excel sheet. This migration process was pretty complicated, but after we were done we noticed that the parents were starting to migrate to online forms of payment, too. This was because everyone was really eager – especially the schools because their manual processes were a source of corruption. If someone took away some funds they would simply claim that the pages were lost or the payment wasn’t traceable, or the incoming money was being used for activities that the principal wasn’t aware of. This corruption ended up forcing the school to migrate their system digitally.

Nowadays, we are not doing it door-to-door anymore. We actually have monthly acquisitions now, and we have 6-10 schools every month. Some of them are referrals. You will know when you build your product and it delivers value to your customer, it just keeps rolling with more requests and referrals. We also believe that if we build trust in the market, we will actually get a return.

How do digitalization and a cashless future affect women?

I imagine that digitalization will open up opportunities for women and will enable women to make some moves. Moms decide everything for the family; they are the ones who make all the purchases, so financial inclusion will actually help women to manage their expenses more easily. Over time, I really believe that women will understand things like savings, returns and interest. I think it will impact women as they will be the first ones to respond to this kind of change, especially if they are the ones in charge of the family.

Why exactly did you decide to jump into financial inclusion?

Financial inclusion is actually a big market and it hasn’t been tapped into yet. If you go to the World Bank Indonesia SME Banking Study 2017 and look at their database, you will see that out of many small-and-medium enterprises (SMEs), only 3% of them are using internet banking and 97% of them are still untapped. Meanwhile, everyone is at war on the consumer side because everyone wants to become the next Alipay. When I went to the schools and saw the reality…it’s pretty sad, you know. 60% of parents don’t pay their tuition fees on time; 40% pay late, and 20% don’t pay at all. Imagine how much of a hassle that would be if you ran a school. On top of this, there is a regulation from the government that prevents you from notifying the student directly if their tuition has not been paid, so as not to discourage students from attending all the classes, you know? In Indonesia when you are talking about education, everyone is trying to make things better for the greater public and for the kids, and yet the reality in the market is that the schools themselves are unable to make enough money to pay for their facilities. So how can they even start thinking about their quality of education?

Meanwhile in the digital world, everyone is so fancy already. Everyone is talking about all these next-level innovations, but very few of these actually touch and are applicable in the current market situation. So that’s why we really want to focus on education. We want to help not only the parents, to allow them to have access to funding, charities and loans for educations, but also these institutions to help them grow and focus on building up their quality of education.

Are there any specific challenges you face as a female founder in Indonesia?

Sometimes, women’s voices are not heard. I have been in the payment industry for quite some time. Even now, I sometimes feel like when we voice something, your audience doesn’t take you seriously because your tone and your voice is different from that of the average man’s. I just find that a woman’s voice is not really heard, especially in a big forum. Men are perceived as more trustworthy in a forum than women.

Do you see that shifting at all? What can we do to change that assumption?

There’s a lot of things that we can do. I don’t like arguing, and I prefer not to be in the spotlight, I’m not sure if other women feel the same or if it’s just me, but I really do think that if women speak up more, it can change something. The thing is, in Indonesia because we have an Eastern culture, we feel as if we should be more reliant on men. That’s one of the factors that have been built into our culture. Over time, this will change because a lot of women now are very outspoken and smart. They tend to not take the spotlight, but this can be changed for sure.

On the other hand, are there any instances where you have felt more empowered as a female entrepreneur?

Yes – in my own company. Women are generally better able to multitask, so they can oversee many different problems and different situations. This is something women are very good at and men not so much. So, when you’re making important decisions – or any decision in fact – you have to look over a range of factors. I think in my current position, I need to be sensitive to many things and consider a lot of aspects as well in decision-making. I think most of the decisions are being made based on those considerations, and I think that’s where I am playing a bigger role.

Did you feel empowered to become an entrepreneur? Was there a lot of support and did you face a lot of doubt?

I think in whatever situation you are, regardless of your job title, the utilization of your knowledge and your wisdom can be empowering in many ways. I received a lot of support, especially from friends and family because they were not gender biased. I have friends who developed their businesses from the early age of 18; they were already entrepreneurs and they were always ready to help and gave us non-entrepreneurs the courage to start thinking of building a business. It’s actually a contagious act 🙂 When my friends (who are non entrepreneur) were talking about their jobs and how stressed out they were getting from their tasks, I asked them why they didn’t just become entrepreneurs – it’s something very challenging yet enjoyable. It’s full of ups and downs, but the thing is this feeling is something that I really appreciate, and I think most of the entrepreneurs who have been doing this business since an early age understand that and encourage other people to do the same.

What is it like to toggle being both an entrepreneur and being a mother – both 24-hour, full-time jobs?

It’s tough. It’s so, so tough. I always feel guilty if I don’t see my son for at least three hours a day, but the thing is that I love both my work and being a mother. Sometimes when I’m stressed and I don’t know what to do at work, I go home and feel so safe because I see my son and suddenly whatever happened in the office doesn’t really matter anymore. It’s a big challenge, but women should not give up their careers to become mothers. Because in order to be a good mom, you need to be a good role model, too. Full time moms are great, don’t get me wrong. But you don’t have to be a full-time mom to be a perfect mom. You can be both: you can be a successful woman as well as a mom at home. It does get really tough because if something at office is stressing you out, you tend to bring it with you to home and vice versa. So, you need to find a balance. I have to give myself some credit sometimes and tell myself I need to do this in order to be a good role model for my son.

Speaking of role models, do you have any role models that you personally look up to?

Yes, my mom. She’s a very tough mom. My childhood was not wonderful because my dad left and my mom was a single mother who raised three children. So, she has been my role model forever.

My mom was a victim of abuse from my dad; the abuse got to the point where she was in a coma for three months. After that, my dad disappeared and then no one was taking care of us. When my mom regained consciousness, the doctor told her that she would probably never walk again. She had never worked before, but she thought that if she didn’t get a job then how could she feed her kids and send them to school? She fought a lot and started walking again, which the doctors found miraculous. She juggled three jobs a day just to raise us and feed us and to give us proper shelter and education. That’s a lot to handle.

If you were to give a girl advice on becoming an entrepreneur, what would you tell her?

Just jump in, and you’ll find a way. If there’s a will there’s a way. Believe in yourself.